Gm. Elona Musk is now the richest woman in the world. I don’t make the rules 🤷♀️

Welcome to Issue 03 of The Quest Digest, where we break down Silicon Valley news for you every week, in 3 minutes.

Was this forwarded to you? Subscribe here.

Yuga Labs acquires CryptoPunks NFT collection

Bored Apes Yacht Club maker Yuga Labs announced they have acquired the rights to the CryptoPunks and Meebits NFT collection.

CryptoPunks is one of the oldest and most valuable NFT brands. The lowest price punk available is 62.25 ETH ($172,743.13 USD).

The co-founders of CryptoPunks, said they thought Yuga Labs would be better stewards of the project moving forward.

They plan on granting IP and commercialisation rights to CryptoPunks and Meebits owners. Doing so will allow NFT holders to create works and products based off their NFTs in the same way Bored Ape owners have.

Our Take

IP rights to NFT projects may not seem valuable, but people are finding ways to create derivative projects.

BAYC members write stories around their apes. Reese Witherspoon and Mila Kunis are launching TV shows based on NFT projects they acquired. This deal means CryptoPunk holders can do the same and strengthen it’s brand and community.

The acquisition is also one of the first sign of the NFT space professionalising and consolidating. Outside of NBA’s Top Shot, most big NFT brands have operated out of Discord servers. Yuga Labs is starting to act like a real company by consolidating.

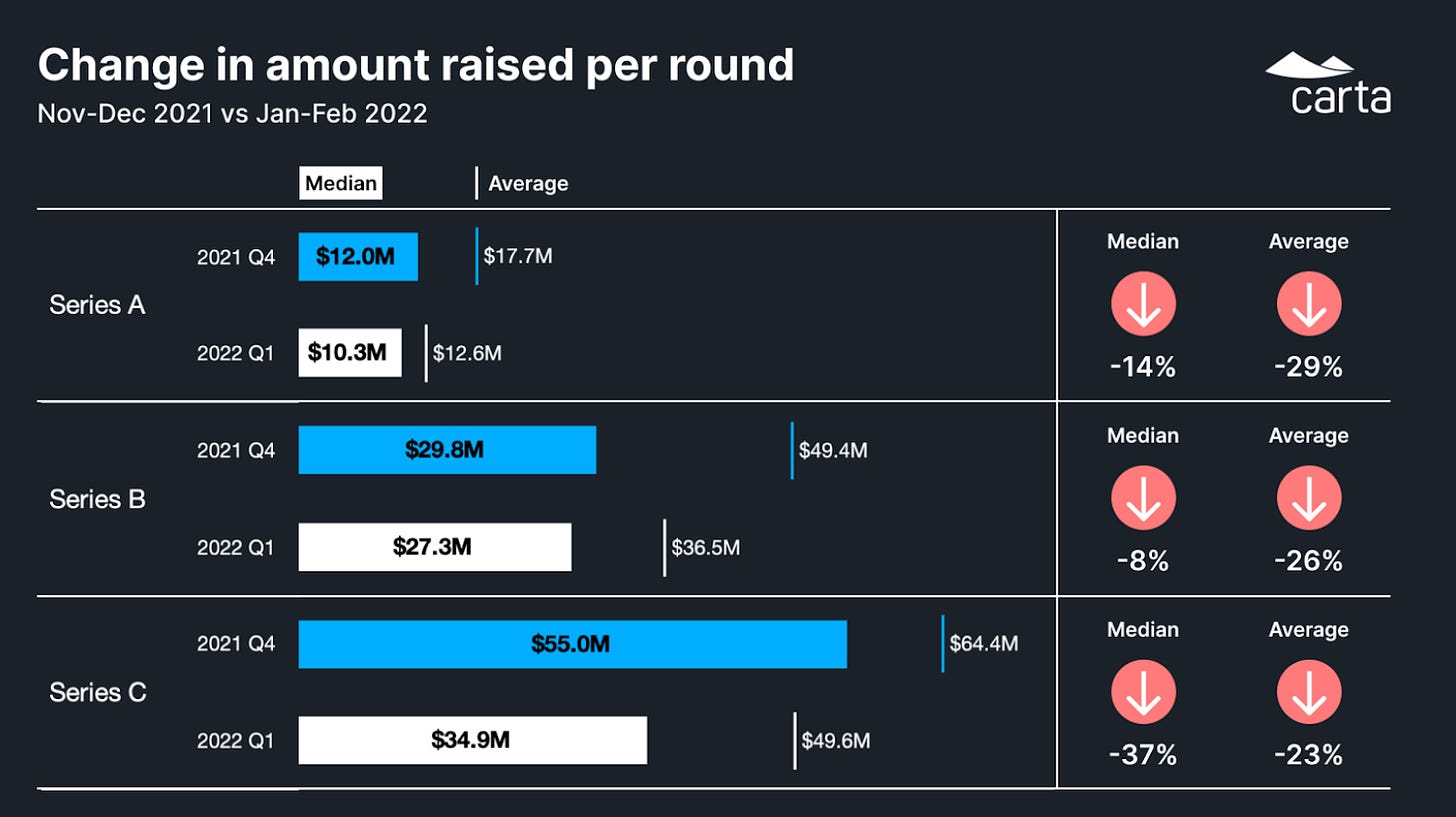

VCs are pulling back on US Series A, B, and C valuations

According to data collected by unicorn equity management startup, Carta – round sizes and valuations from Series A to C stages in the US are in decline.

As a Recap:

Series A rounds posted the largest average decline in round size. Larger Series A rounds are becoming less frequent.

Series B round data is similar, however with a smaller median decline

Series C rounds are the most extreme, seeing the largest median and average declines in amount raised

Our Take

The Good News:

For investors hunting for a deal, prices are discounted

Take it as good or bad news, but it’s a sign we’re at the cusp of a correction which is necessary for long-term growth and so that startup valuations are realistic with business performance

The Bad News:

Founders seeking their next raise may find sourcing capital to be tricky

It’s an indication of a bear market and reflects ongoing uncertainty in the global economy

Despite all this, the numbers show the market is slowing down – but funding is still ongoing. The main question on everyone’s mind is how much the market will slow down over the next few quarters.

Linktree now valued at $1.3 billion

Aussie-based startup Linktree hit unicorn status with $150 million raise. Now the company is valued at $1.3 billion USD. The round was led by US investors Index and Coatue, and included repeat backing from Australian VC firm, Airtree.

The company boasts users like Selena Gomez, TikTok and Major League Baseball and currently has 24+ million users, with 40,000 signups a day.

Our Take

Skeptics will ask “how far can a company displaying links really go?”

But Linktree has moved quickly, introducing integrations with PayPal, and Shopify and acquiring Songlink/Odesli to create a Music Link feature to support artists. Linktree says it helped 1.7 million people drive 1.2 billion clicks to commerce-related sites in 2021.

The company also offers subscription options to expand creator monetisation tools.

Linktree declined to comment on revenue figures, touting that if they help creators win, they’ll pay for adding value. So, there may still be reason to be skeptical… for now.

🔥 Press Worthy

Bored Apes Yacht Club launches official ‘ApeCoin’ token

E-commerce startup Bazaar scores Pakistan’s 2nd biggest funding round

Meta removes altered deepfake of Ukraine’s President Volodymyr Zelensky

Uber and Lyft raises fees due to rising gas prices

Feedback ✍️

Did you like this issue? We want to hear about your feedback in public. Tweet at us @thequestmedia 🕊

We will retweet everything (so you know we’ve seen it)!

The Quest Digest is written by Hannah Ahn and edited by Brent Liang, two dropouts who hate long tech newsletters. You can sign up to our next issue below.